7 Best AI Accounting Software in 2024

In today’s fast-moving business world, technology plays a crucial role in making work easier and faster. As companies use more digital tools to make their work smoother, one important area that has improved a lot is accounting. Thanks to Artificial Intelligence (AI), accounting has become much better, saving time and reducing mistakes.

In this article, we will explore the top 7 AI accounting software solutions for 2024, delving into their key features, limitations, and pricing, to help businesses make informed decisions in selecting the right tool for their needs.

Why Use AI for Accounting Software?

The utilization of AI in accounting software brings numerous benefits to businesses:

- Automation: AI automates repetitive tasks like data entry, invoice processing, and expense tracking, saving time and reducing errors.

- Data Analysis: AI quickly analyzes financial data, offering insights for better decision-making and planning.

- Accuracy: AI ensures precise processing, minimizing accounting errors and maintaining compliance.

- Scalability: AI accounting software adapts to business growth, handling increased transactions without performance issues.

- Efficiency: By streamlining processes and reducing manual work, AI allows finance teams to focus on important tasks, boosting productivity.

As businesses keep up with digital changes, AI accounting software has become a crucial tool for making operations more efficient and staying competitive in today’s market.

7 Best AI Accounting Software 2024

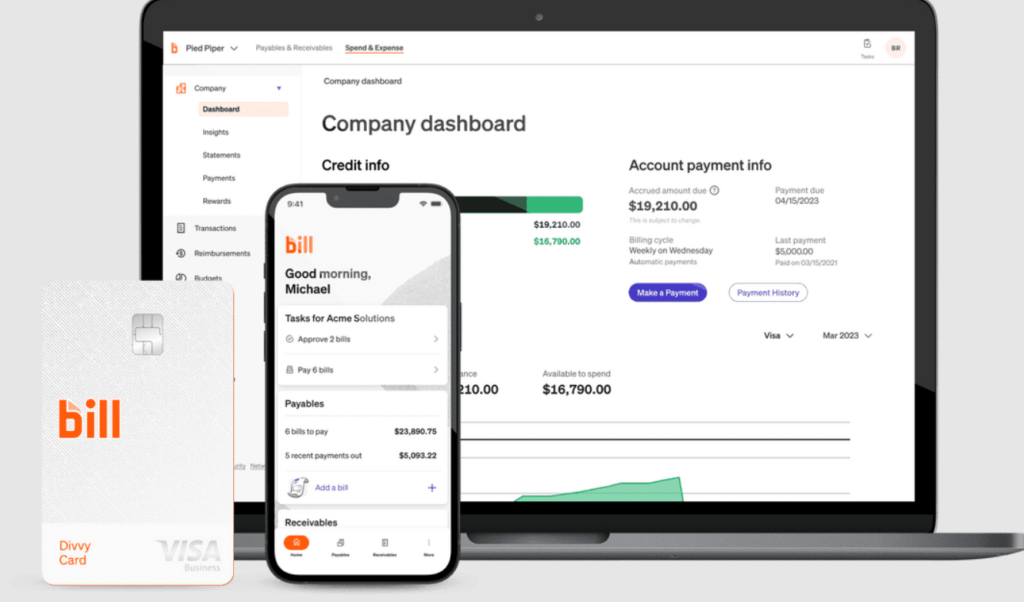

1. Bill

Bill is a AI-powered accounting software that transforms the way businesses handle invoices. By using the power of AI, Bill effortlessly converts traditional invoices into digital bills ready for payment with just a click. This eliminates the need for manual data entry, boosting efficiency and accuracy in expense reports.

But Bill doesn’t stop there. It seamlessly integrates with other software systems, streamlining the entire accounting process and saving valuable time and effort. Plus, Bill provides real-time insights and alerts, empowering businesses to make informed financial decisions quickly.

With Bill, accounting tasks are simplified and optimized, thanks to its AI-driven automation and intuitive features. Say goodbye to tedious manual invoice processing and hello to streamlined accounting with Bill.

Key Features

- Automatic 2-way sync with QuickBooks Online, QuickBooks Pro, QuickBooks Premiere, and Xero.

- Centralized bill management from a single inbox to prevent missed payments.

- Quick and easy bill entry process.

- Access a network of over 4 million vendors via the Bill network.

- Unlimited document storage for important files.

- Multiple payment options including ACH, virtual card, and credit card.

- Custom approval policies to maintain control over expenses.

- Assign custom user roles for managing access and permissions.

Limitations

- It may not be cost-effective for small-scale business owners.

- Invoices can go into spam folders due to flagging by email servers, leading to delayed payments.

- Reaching offline customers who do not access the internet can make the process difficult.

- A badly drafted, vaguely worded document can be wrongly interpreted or easily disputed, delaying payment.

- Invoices being issued late can encourage customers to be equally relaxed about settling the debt.

Pricing

- Essential: $45/month

- Team: $55/month

- Corporate: $79/month

- Enterprise: Contact for pricing

To Keep updated pricing click here.

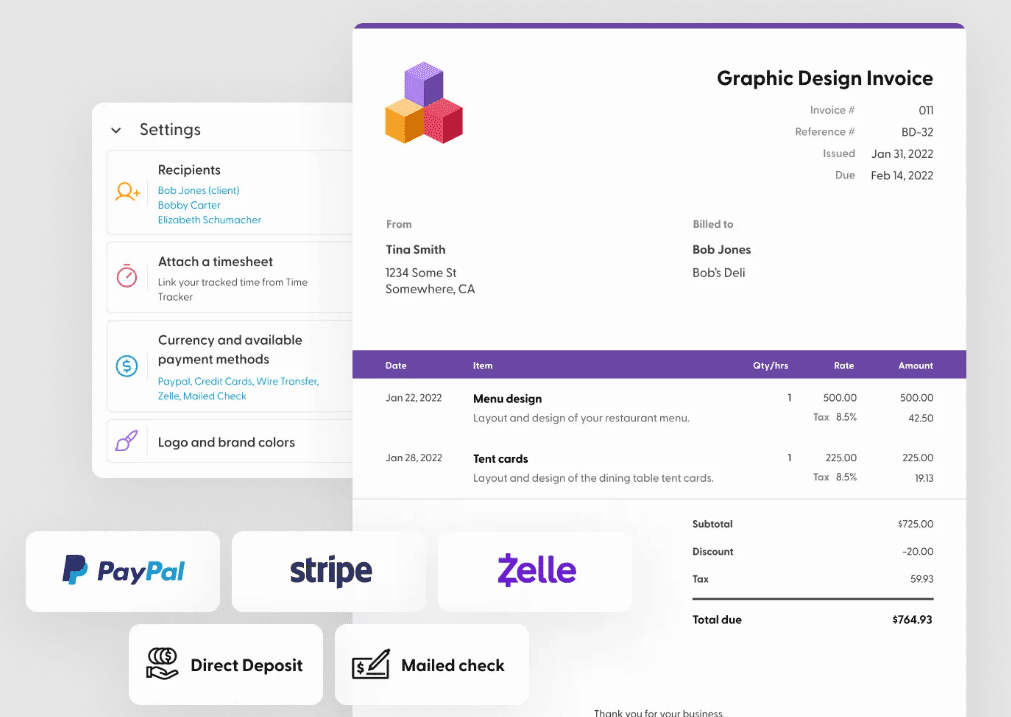

2. Indy

Indy is your go-to AI-powered accounting software, tailor-made for individuals, freelancers, and sole proprietors. Say goodbye to tedious accounting tasks like bank reconciliations, tax declarations, and expense tracking – Indy automates it all for you. This means less time spent on paperwork and more time for what you love.

But that’s not all – Indy goes beyond just accounting. It seamlessly integrates with other systems, giving you easy access to transaction receipts, income sources categorization, and personal spending allocations – all from one convenient platform. No more jumping between different tools or spreadsheets.

And here’s the cherry on top – Indy doubles as a project management tool. Imagine having all your work-related documents and communications neatly organized in one shared workspace. With Indy, managing projects and tracking finances becomes a breeze.

Key Features

- Indy enables effective income management.

- Keep track of expenses with ease using.

- View all transactions in one place.

- Generate VAT declarations seamlessly.

- Indy can automatically file your tax returns.

- Graphically display monthly and annual spendings.

- Automate bank reconciliations.

Limitations

- The free plan limits users to three clients.

- Some user reviews report inaccuracies when manually tracking time.

Pricing

- Free Plan

- Pro Plan: $12/month (7-day trial)

To Keep updated pricing click here.

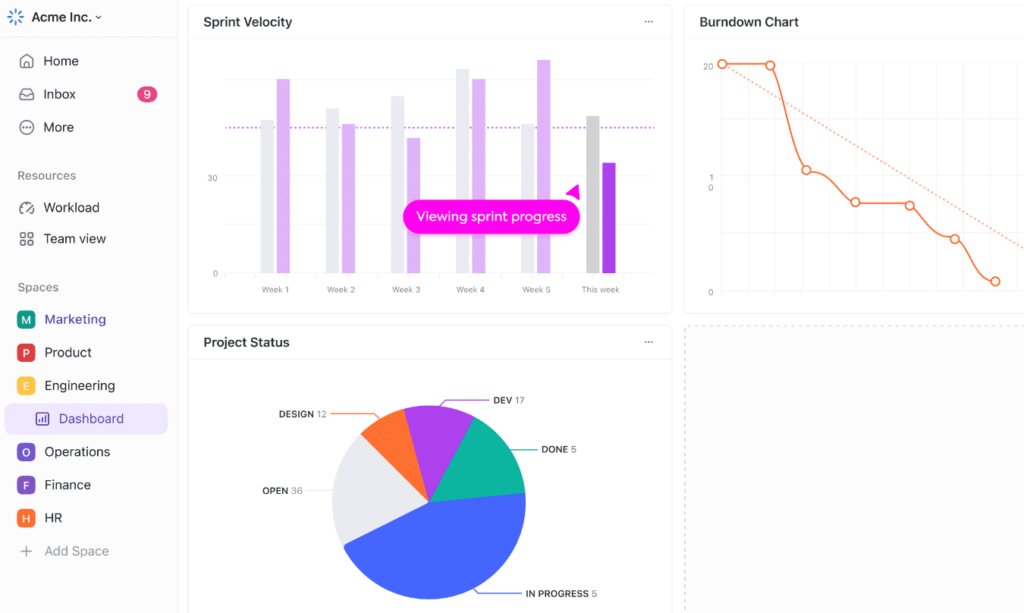

3. ClickUp

ClickUp is a smart cloud-based software that simplifies financial tasks using AI. It’s like having a personal assistant for your business, helping manage accounts and generate reports quickly. Plus, it’s not just for finances – ClickUp also helps with project management, keeping all your documents and communications organized in one place.

With ClickUp, you can integrate over 1,000 apps like Google Suite and Quickbooks, making it easy to sync your accounting tools. This versatility makes ClickUp a great choice for businesses looking to streamline their financial processes.

Key Features

- ClickUp’s unique hierarchy scales with your needs.

- Customize task management with over 35 ClickApps.

- Automate tasks with 50+ actions, triggers, and conditions.

- Save time with hundreds of templates.

- Integrate seamlessly with over 1,000 tools.

Limitations

- Learning curve could a bit high and hard to use all the features.

- ClickUp has limited email integration.

- ClickUp does not have a CRM for client information.

- free plan limits users to three clients.

Pricing

- Free Forever: Limited features with usage limits

- Unlimited: $10/month

- Business: $19/month

- Enterprise: Contact for pricing

- ClickUp AI: Available on all paid plans for an additional $5 per member per month

To Keep updated pricing click here.

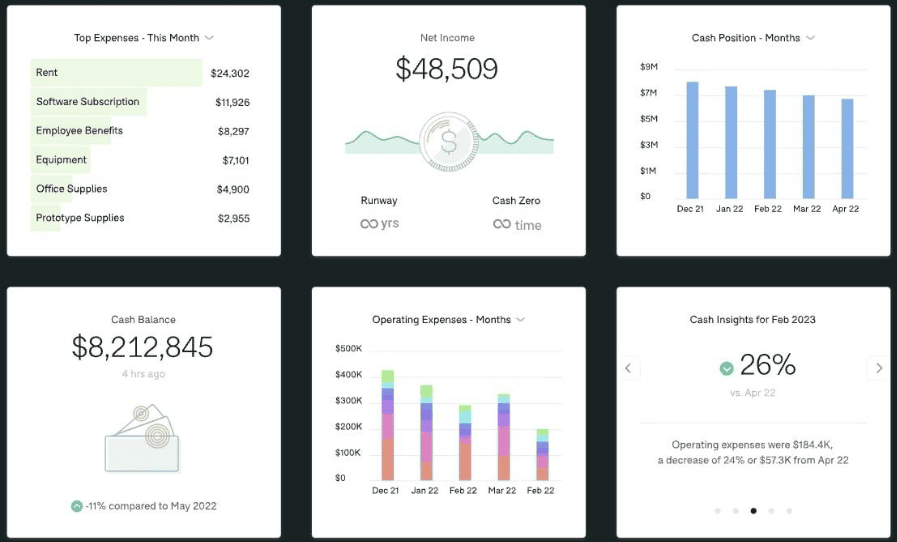

4. Zeni

Zeni is your all-in-one financial partner, specially crafted for startups. Powered by AI, Zeni simplifies accounting tasks like bookkeeping, spending monitoring, and budgeting, allowing startups to take charge of their finances with ease.

But that’s not all! Zeni goes above and beyond by offering a suite of additional services, including tax returns, fractional CFO services, payroll management, bill pay, and employee reimbursements. With Zeni’s finance team at your service, you can rest assured that all your financial needs are fully taken care of.

Designed with startup founders in mind, Zeni puts you first. Our platform is built to help you focus on what matters most – growing your business. With Zeni, you can access critical financial data anytime, anywhere, make informed decisions, and achieve financial peace of mind.

Key Features

- AI-powered bookkeeping updates your books daily, providing real-time insights.

- Comprehensive accounting services ensure smooth financial operations.

- Assistance in navigating the complex world of taxes.

- Access to high-level financial planning and analysis.

- Ensuring accurate and timely payments for employees.

Limitations

- More advanced features are only available for higher-level plans.

- It may not be cost-effective

Pricing

- Full Service Plan: $549/month

- Professional Plan: $799/month

- Enterprise Plan: Custom pricing

To Keep updated pricing click here.

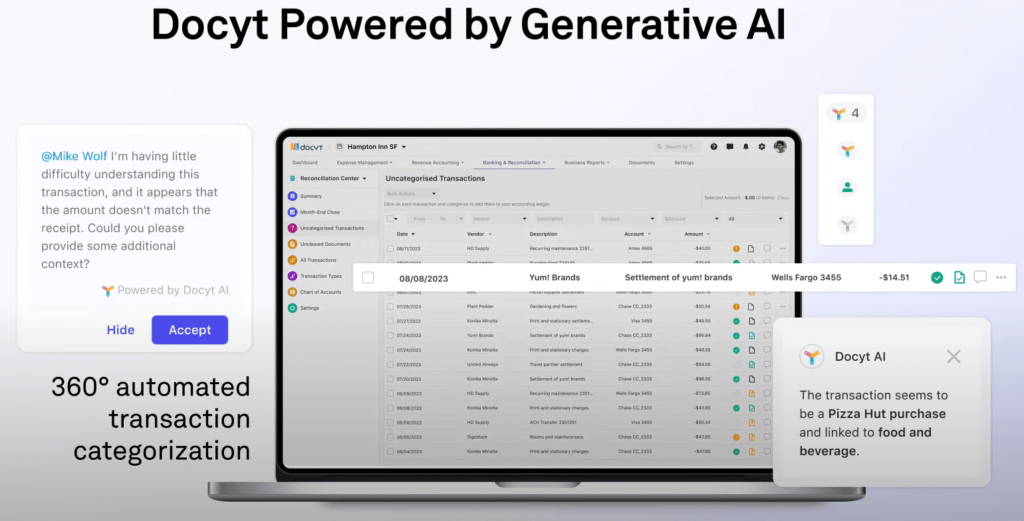

5. Docyt

Docyt is a cutting-edge AI-powered accounting automation platform designed to revolutionize financial workflows for businesses. Leveraging advanced machine learning algorithms, Docyt digitizes financial data, streamlines workflows, and automates the reconciliation of accounts, providing real-time insights into the financial status of businesses.

With its advanced generative AI features, Docyt empowers accounting professionals to eliminate manual tasks, accelerating financial workflows and providing precise, real-time visibility into the financial health of businesses. This technology is particularly beneficial for SMBs, franchises, accounting firms, and internal finance teams.

Docyt is highly adaptable and scalable, capable of managing repetitive bookkeeping tasks for each entity individually. It offers flexible reporting options, including consolidated financial reports tailored to specific requirements. Furthermore, Docyt enables faster decision-making by providing real-time financial reports and dashboards on Key Performance Indicators (KPIs) and other essential metrics.

Key Features

- Automates workflows for bill pay, reimbursement, receipt capture, and credit card management.

- Offers automated reconciliation for both revenue and expenses.

- Handles vendor 1099 management and reporting.

- Provides real-time financial reporting including P&L, balance sheet, and customized reports.

Limitations

- There can be a time delay when asking a question, as most of their personnel are overseas.

Pricing

- Impact Plan: $299/month

- Advanced Plan: $499/month

- Advanced Plus Plan: $649/month

- Enterprise Plan: Starting at $999/month

To Keep updated pricing click here.

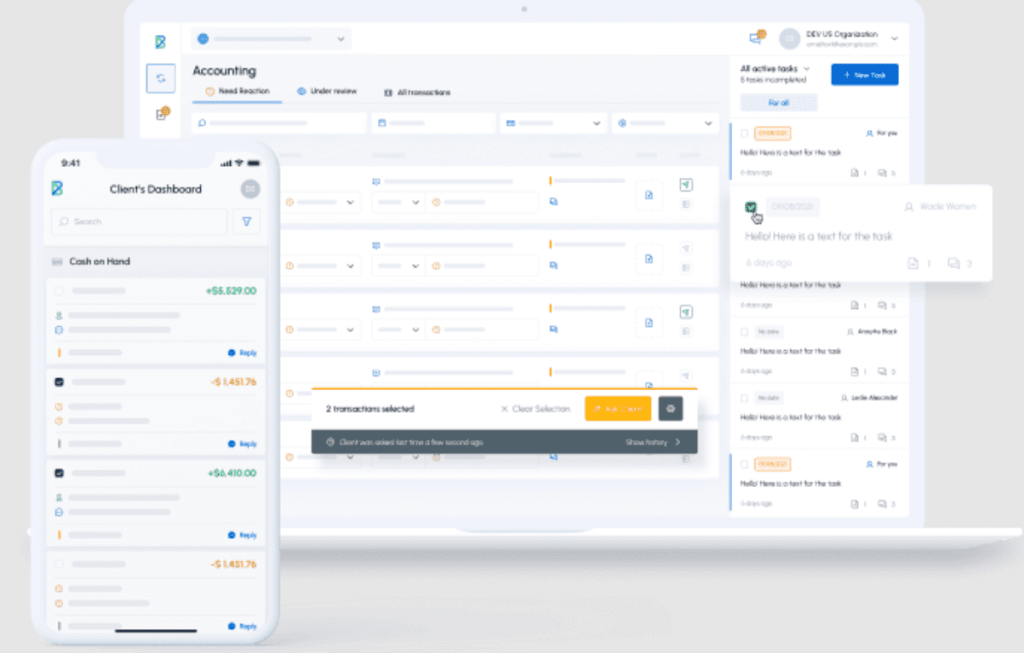

6. Booke

Booke, an AI-driven accounting software, streamlines bookkeeping tasks through the utilization of artificial intelligence. By leveraging AI technology, Booke effectively resolves uncategorized transactions and coding errors, facilitating improved communication with clients and automating a significant portion of workload. This results in substantial time savings, reducing the burden by at least 2 hours per client per month.

Moreover, Booke offers advanced generative AI features that further streamline and accelerate accounting processes. These features empower accounting professionals to eliminate manual tasks within financial workflows, while providing precise, real-time visibility into the financial health of their businesses.

Additionally, Booke is highly adaptable and scalable to the needs of any business. It efficiently manages repetitive bookkeeping tasks for each entity individually and offers flexible reporting options. Furthermore, Booke facilitates faster decision-making by delivering real-time financial reports and dashboards on Key Performance Indicators (KPIs) and other essential metrics, ensuring businesses stay agile and responsive to changing market dynamics.

Key Features

- Automatically categorizes transactions, saving time and reducing errors.

- Extracts data from invoices, bills, and receipts in real-time.

- Integrates with Xero, QBO, and QBD, allowing seamless connection to preferred accounting software.

- Allows users to easily manage documents in bulk.

- Generates interactive reports.

Limitations

- Offshore Resources: Dealing with offshore resources can be challenging due to unclear phone/Google connections.

- Time Delay: There can be a time delay when asking a question, as most of their personnel are overseas.

Pricing

- Data Entry Automation Hub: $18/month

- Robotic AI Bookkeeper: $45/month

To Keep updated pricing click here.

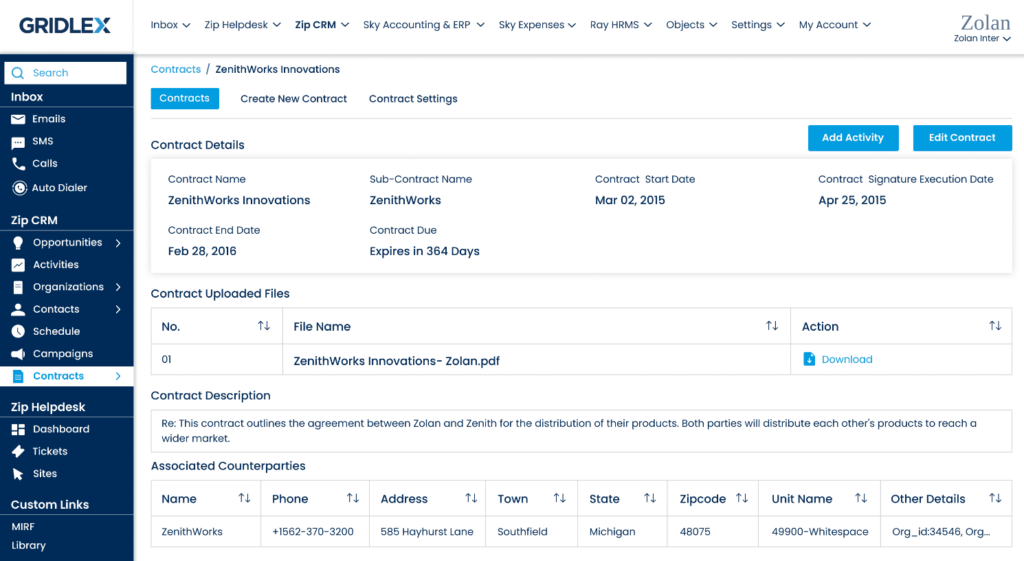

7. Gridlex

Gridlex, an AI-powered accounting software, employs machine learning to automate financial workflows, digitize data, and streamline operations. By continuously reconciling accounts and providing real-time insights, Gridlex enables businesses to maintain accurate financial records and make informed decisions promptly.

Beyond its core accounting functions, Gridlex incorporates advanced generative AI features that expedite processes, eliminating manual tasks and enhancing efficiency. This empowers accounting professionals to focus on strategic initiatives while gaining precise visibility into their business’s financial health.

Designed for scalability, Gridlex adapts to evolving business needs, managing repetitive bookkeeping tasks for each entity and offering flexible reporting options. By delivering real-time financial reports and dashboards, Gridlex facilitates faster decision-making based on Key Performance Indicators (KPIs) and other essential metrics.

Key Features

- Allows efficient tracking and categorization of expenses.

- Can generate comprehensive financial reports, including balance sheets, income statements, cash flow statements, and custom reports.

- Effectively manages payroll, processing payments, calculating taxes, and generating payslips.

- Simplifies tax preparation by calculating tax obligations, preparing tax forms, and staying up-to-date with tax laws and regulations.

- Automatically compares internal financial records.

Limitations

- Manual data entry often leads to errors and inconsistencies.

- Traditional methods of financial management often prove inefficient, prone to errors, and time-consuming.

Pricing

- Start Plan: $10/month

- Grow Plan: $30/month

- Scale Plan: Contact for pricing

To Keep updated pricing click here.

Wrapping Up

In conclusion, the role of AI in accounting software has brought significant advancements in automating financial processes, enhancing accuracy, and providing real-time insights. As showcased by the top 7 AI accounting software solutions for 2024, businesses can leverage AI to streamline their operations, boost efficiency, and stay competitive in today’s fast-paced business environment.

With features such as automation, data analysis, and scalability, AI accounting software offers unparalleled benefits for businesses of all sizes. While each software has its unique strengths and limitations, they all contribute to simplifying financial workflows and empowering finance professionals to make informed decisions.

As the role of AI continues to expand in every field, embracing AI accounting software is essential for businesses looking to stay ahead in the digital age. By leveraging the power of AI, businesses can drive efficiency, productivity, and profitability in their financial operations, paving the way for future success.

Other Software To Look: